In-car payments – just hype or automotive revolution?

Market research institutes and consulting firms are predicting an impressive market volume in the three-digit billion range for in-car payments. Is the vehicle truly becoming a “payment instrument,” signifying an automotive revolution, or is it just another hyped-up trend? Philip Blatter, Managing Director of the Karlsruhe-based fintech company PACE, and Henning vorm Walde, Managing Director of paydirekt GmbH, delved into this topic at the scene of the action – inside the car.

Blatter: The future of digital payment is a key issue for us as a provider of mobile payment solutions. Everyone is talking about in-car payments right now, but the more important question is: what do users truly want and need, and where is the journey heading?

vorm Walde: Yes, in my opinion this is the crucial question. Payment is fundamentally a dynamic topic and is currently gaining momentum in the automotive sector. For me, the fact that payment is now extending into the realm of cars is a logical progression. However, the more exciting topic in the mobility sector, in my view, is mobile payment via apps.

Blatter: Absolutely. There are many conceivable use cases for the automotive industry and financial service providers, including sales potential. Payment via the car can certainly enhance convenience for vehicle users, but, in my opinion, the real shift is happening elsewhere. Driving and usage behavior are changing significantly. Although the ADAC recently reported a record high in driving tests, alternative mobility concepts, such as car sharing, are also gaining traction. Particularly young people and occasional drivers will lean towards car sharing instead of purchasing their own vehicles.

vorm Walde: I agree with that. The sharing economy that you are referring to is no longer a niche phenomenon. At the beginning of 2023, almost 4.5 million eligible drivers had already registered for car sharing, which is around a third more than in the previous year. The number of car sharing vehicles has also increased significantly. A large portion of these users are likely to prefer flexible in-app solutions that are not tied to the vehicle. We see significant long-term market potential here. Therefore, I question the real future opportunities for integrated, personalized payment in your own car, particularly in a B2C-oriented context.

Blatter: I see much less of a “need” for a personal car, especially with the ongoing developments towards autonomous driving. Apps like Uber allow me to select a ride option with a tap of my finger, providing flexible transportation to and from my destination – perhaps even driverless in the near future. Wouldn’t it make much more sense if I could use my digital wallet in my smartphone, with the vehicle only displaying information for this private device?

vorm Walde: If we compare the whole thing with the smartphone, which allows us to carry our entire digital identity everywhere, we are still a long way from reaching that level of maturity in the automotive industry. The process of cars accessing clouds and loading my user profile based on facial recognition requires high standards and a major investment in existing infrastructures worldwide. In my opinion, mobile payment solutions for vehicle-related services, such as refueling, washing or parking, are much more tangible and already in high demand.

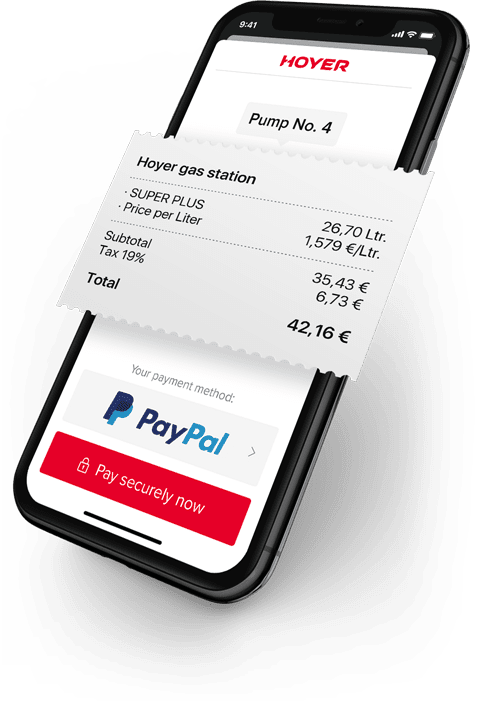

Blatter: We have experienced this as well. It’s not without reason that we are expanding our services to include offerings like vehicle washing, tolls, and charging. This year alone, 2023, we almost doubled our station network, enabling customers to make mobile payments at over 7,000 fueling stations in 13 countries. But in your opinion, is there still a chance that in-car payments will be able to establish themselves in the long term?

vorm Walde: It is crucial to respond to the needs of customers. As I already mentioned, I see sensible use cases for in-car payment primarily in the B2B segment. Here, It’s important to offer convenient and seamless solutions that go beyond just convenience, integrating efficiency and security. Authentication processes must be secure yet uncomplicated for the user.

Blatter: That’s right, which is why we see fleet management as a great opportunity for integrated payment solutions and are focusing on B2B in this area. In addition to a convenient solution, the main aim here is to increase efficiency for fleet managers and drivers. Deep integration makes total sense, especially where a vehicle is refueled or washed, and the fleet operator, not the driver, pays the bill. Initial pilot projects indicate that fuel fraud and other fraud scenarios can be effectively prevented this way.

vorm Walde: Yes, these are use cases that meet customer needs 100 percent. The payment industry simply has to keep an eye on customer needs, then we will see a lot more dynamism and exciting solutions that offer decisive added value.